Valuable Understanding Plans Future

Exploring Insurance Services: How They Safeguard Your Life and Well-Being

Insurance services are crucial in ensuring financial safety against unexpected events. These services include many types, such as homeowners, health, and auto coverage, designed to handle specific risks. Grasping the operation of these services is crucial for anyone seeking to protect their assets and well-being. While navigating the complexities of insurance, they may begin to wonder what coverage best suits their unique circumstances. The answers could greatly impact their future safety and stability.

Understanding Different Types of Insurance

Many people recognize the importance of insurance, knowing the various types can be a challenge. Insurance is a broad field that includes many categories, all intended to address particular needs. Health insurance, for instance, provides coverage for medical expenses, providing individuals access to healthcare services. Auto insurance protects against financial loss in the event of theft or vehicle accidents. Homeowners insurance safeguards property against loss or damage from events like fire or theft. Life insurance offers financial support to beneficiaries upon the policyholder's death, guaranteeing their loved ones are cared for. Additionally, there are specialized types such as disability coverage, which offers replacement income if an individual is unable to work because of illness or injury. Every type serves a unique purpose, showing the importance of assessing personal needs to pick the best coverage. Grasping these differences is crucial for making informed decisions about insurance choices.

The Basics of How Insurance Works

To comprehend insurance operations, one must know the basic principle of risk management. Insurance operates on the concept of sharing risk among many people. When a person purchases an insurance policy, they agree to pay a premium in exchange for protection from financial risk. This structure permits carriers to gather money from many clients, building up capital to satisfy demands made by those who experience losses.

The initial step occurs when individuals assess their specific hazards and choose suitable protection plans. Carriers subsequently analyze the degree of risk, determining premiums considering elements such as health, age, and personal habits. By distributing the cost among many participants, coverage reduces the effect of unexpected events like accidents, illnesses, or natural disasters. In the end, this framework offers policyholders with peace of mind, knowing they have a safety net ready for when unpredictable situations happen.

Advantages of Possessing Insurance Protection

Having insurance coverage offers a multitude of upsides that greatly enhance financial security and peace of mind. A major upside is the safeguard it offers against unexpected financial burdens, for instance, damage to property or healthcare costs. This safety net allows individuals to handle hazards better, certain they have aid when crises arise. Moreover, being insured often provides access to essential services, such as healthcare, which could be financially out of reach.

In addition, being insured promotes greater life consistency, enabling individuals to focus on their goals without the constant worry regarding future monetary losses. Coverage may also boost financial reputation, because financial institutions frequently regard people who are insured more positively. Taken together, insurance is a vital mechanism in mitigating exposure, building trust and durability as they encounter life's unknowns while timely resource safeguarding overall well-being.

Choosing the Right Insurance for Your Needs

How can individuals navigate the intricate realm of insurance options to locate the protection that fits their unique circumstances? Initially, clients must evaluate their specific needs, considering factors such as health conditions, family size, and monetary commitments. This evaluation helps narrow down the necessary forms of coverage, be it auto, life, health, or home coverage.

Subsequently, people should investigate various providers and contrast their policies, concentrating on premiums, deductibles, coverage limits, and policy terms. Consulting consumer testimonials and seeking recommendations may also offer useful information.

Financial constraints are crucial; people must select coverage that balances adequate coverage while remaining inexpensive. Additionally, reviewing the stipulations of each policy ensures that there are no surprises during the claims process. Through these actions, individuals can decide wisely, securing the right insurance coverage that aligns with their specific needs and financial goals.

The Outlook for Insurance: Emerging Patterns

The future of insurance is poised for significant transformation, driven by emerging technologies and evolving customer requirements. Insurers are progressively implementing artificial intelligence and machine learning to improve risk evaluation and make processing claims more efficient. These innovations make tailored policies possible designed for individual needs, fostering customer loyalty and satisfaction.

Furthermore, the rise of insurtech startups is challenging traditional insurance models, encouraging flexibility and competitive pricing. Blockchain technology is also gaining traction, providing better visibility and security in transactions.

Furthermore, as consumers become more aware of the environment, demand for green insurance options is rising. Insurers are developing new ways to provide protection that supports eco-friendly practices.

Telematics and wearables are additionally changing health and auto insurance, offering instant information that can help calculate premiums precisely. Overall, the insurance landscape is changing quickly, emphasizing simplicity, personalization, and sustainability for a new generation of policyholders.

Top Questions

What Action is Required After Experiencing a Loss Covered by Insurance?

Following an insured loss, an individual should immediately inform their insurance provider, record the harm, obtain supporting documentation, and file a claim, remembering to save documentation of all communications throughout the process.

What Determines Insurance Rates for Different Individuals?

Insurance premiums are calculated based on factors such as age, health, location, coverage amount, and hazard appraisal. Insurers review these elements to determine the likelihood of a claim, thereby setting appropriate premium rates for individuals.

Is It Possible to Modify My Policy During the Term?

Certainly, individuals can typically alter their plan mid-term. Nonetheless, this procedure might differ depending on the copyright's stipulations and rules, possibly influencing your protection, the rates, or incurring costs for modifications requested.

What restrictions are Frequently Found in Policy Contracts?

Common exclusions in coverage agreements include pre-existing conditions, willful destruction, wartime activities, catastrophic events, and specific dangerous pursuits. Insured individuals must thoroughly examine their policies to understand these limitations and steer clear of surprising claims refusals.

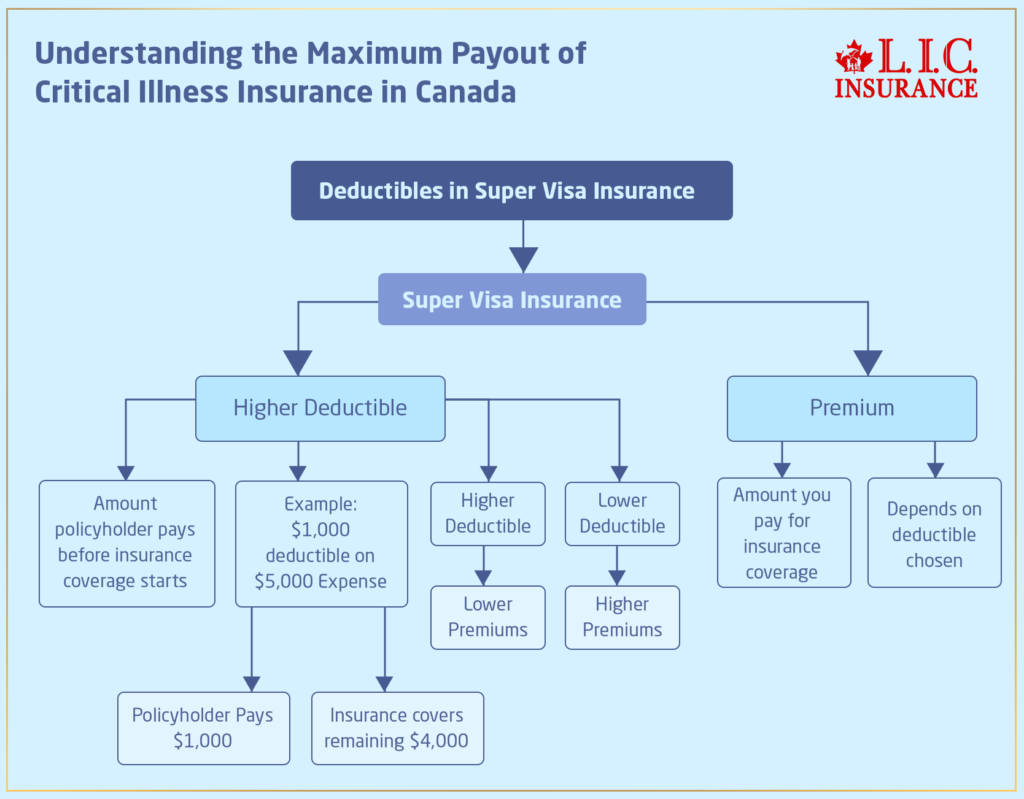

In What Way Do Deductibles Impact My Coverage Payouts?

The deductible amount decreases the provider's reimbursement level by requiring policyholders to cover a set upfront amount before the claim is finalized. This significantly affects the final payout amount, shaping the total cost burden in claim scenarios.